Basic Ideas

- What is Responsible Property Investing?

The former UN Secretary General Kofi Annan proposed the "Principles for Responsible Investment" (PRI) in 2006 as a concept to incorporate several issues related to environmental, social, corporate governance (ESG issues) into the investment management. (As of March of 2010, more than 700 orgaizations all over the world including institutional investors and asset management companies have signed.) Based on this concept, the UNEP FI property working group (PWG) is promoting "Responsible Property Investing" (RPI) as a concept to apply Principles for Responsible Investment to property investing. RPI is pursuing the sustainability in the whole life cycle of real estates. It is explained as an approach that considers environment, society and corporate governance in addition to the usual financial objectives, and improves the social performance related to property environment. - The UNEP FI property working group is presenting the following ten RPI strategies to explain the concept of the objectives of Responsible Property Investing. Property portfolios and asset management plans are regarded as fulfilling heavier responsibility as stocks of owned buildings contribute to improving performance by various social environment indices.

- Investing in environmental properties implements this RPI principle.

Ten strategies of Responsible Property Investing

- Energy saving (improving facilities for saving energy, green power generation and green power purchase, buildings with high energy efficiency, etc.)

- Environment protection (saving water, recycling of solid waste, protection of habitats, etc.)

- Spontaneous certification system (green building certification, finishing using certified sustainable wood, etc.)

- Urban improving suited to walking (urban development tailored towards public traffic, community suited to walking, development for multiple usage, etc.)

- Flexiblity in urban renewal and change in property usage (development of unused land, flexibly changeable interior, redevelopment of land with contaminated soil, etc.)

- Safety and health (security ion site, protecting measures against natural disaster, emergency medical care, etc.)

- Welfare of workers (On-site day-care centers, squares, quality of the indoor environment, barrier-free design, etc.)

- Corporate citizen (compliance with laws, disclosure and report of the sustainability, appointment of outside board members, adoption of adoptive provisions like the Responsible Property Investing of UN, relation with stakeholders, etc.)

- Social fairness and community development (providing low-income housing, education program for employment of communities, fair labor practices, etc.)

- Activities as regional citizen (high-quality design, minimizing impact on neighbors, construction process considering region, community welfare, protection of historical places, removal of improper impacts, etc.)

Responsible Property Investing: What the leaders are doing, UNEP-FI

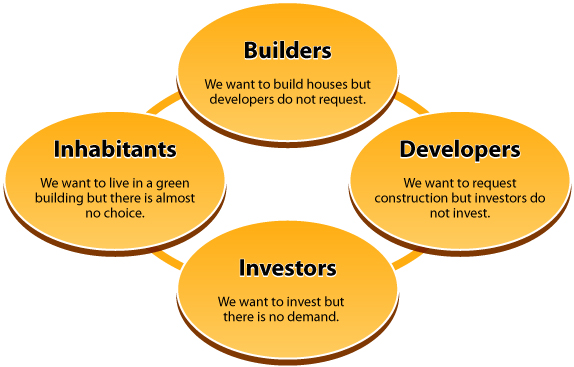

Mr. Paul McNamara, co-chair of the UNEP FI property working group (PWG), pointed out that investors, inhabitants, builders and developers are shifting responsibility onto each other because costructive measures for reducing the environmental load of newly built or existing buildings are lacking. He also mentioned that responsible investors can play an important role in resolving the problem of circulation of responsibility that characterizes the insufficient measures against environmental loads. real estate industries

Figure: Circulation of responsibility

Responsible Property Investing: What the leaders are doing, UNEP-FI

Announcement material

|

What the leaders are doing Japanese version English version |

|

Building responsible property portfolios Japanese version English version |

|---|---|---|---|

|

Relations between owner and tenant in responsible property investing Japanese version English version |

|

Manual on Responsible Property Investing No.1 "Committing and Engaging" Japanese version English version |

|

Manual on Responsible Property Investing No.2 "Index of performance measurement" Japanese version English version |