1.What is the consumption tax exemption system?

The " consumption tax exemption system " allows eligible foreign tourists and Japanese temporary returnees to purchase items such as home appliances, watches, food, cosmetics, etc., without paying consumption tax. This exemption is applicable when these individuals meet the “tax-free requirements”. The purchased items need to be presented to customs at the time of the declaration. Please see the steps below for information about tax exemption in Japan.

1.Confirm Eligibility for Tax-Free Shopping

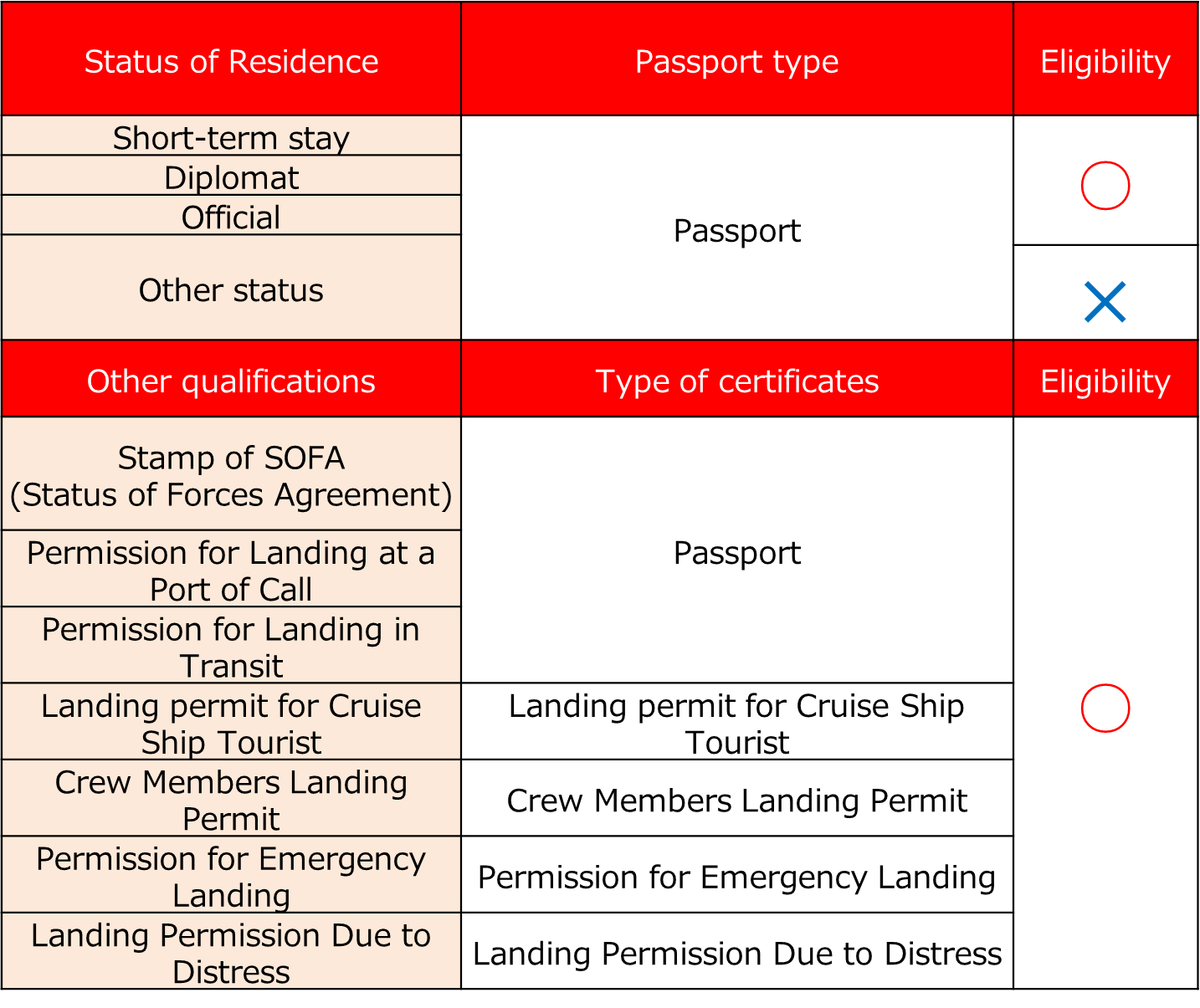

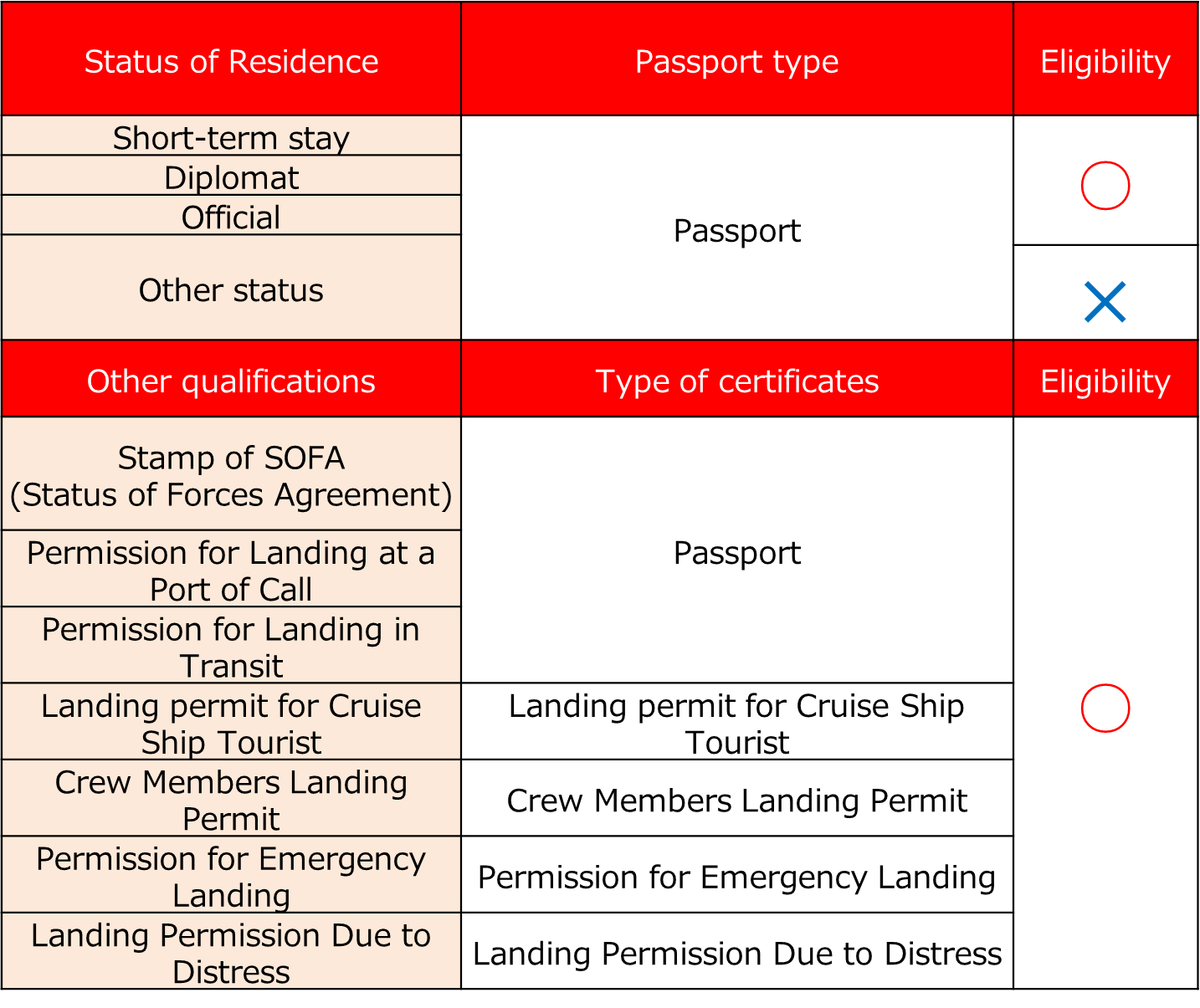

The following individuals are eligible for tax-free shopping

Entering Japan within the past six months (excluding diplomats, government officials, and U.S. military personnel).

* Tax-free shops will verify your entry status within six months using your landing permission certificate or other documentation.

1.Confirm Eligibility for Tax-Free Shopping

The following individuals are eligible for tax-free shopping

Entering Japan within the past six months (excluding diplomats, government officials, and U.S. military personnel).

* Tax-free shops will verify your entry status within six months using your landing permission certificate or other documentation.

2.Find Tax-Free Shops

Look for stores with the following mark to make tax-free purchases.

*Not all tax-free shops display the mark, so please confirm with the staffs if they are qualified.

*Not all tax-free shops display the mark, so please confirm with the staffs if they are qualified.

3.Make Tax-Free Purchases

1.Present your passport or other documentation at the tax-free shop.

2.The tax-free shop will provide an explanation of tax-free regulation.

The items you can purchase are categorized as follows.

*Some tax-free shops may limit eligible individuals and items to specific ones.

<Eligible Items:>

General items

Examples:

*1. The tax-free purchased items must be taken out of the country.

*2. Purchases at the same store on the same day must total at least 5,000 yen (excluding tax).

Consumable items

Examples:

*1. The tax-free purchased items must be taken out of the country.

*2. Purchases at the same store on the same day must total at least 5,000 yen and no more than 500,000 yen (excluding tax).

*3. Consumable items will be provided to you packaged (in bags or cardboard boxes) according to certain methods.

*4.Do not open the packages within Japan.

*5. If the items are consumed or the packages are opened in Japan, you may be required to pay the consumption tax at the time of departure.

2.The tax-free shop will provide an explanation of tax-free regulation.

The items you can purchase are categorized as follows.

*Some tax-free shops may limit eligible individuals and items to specific ones.

<Eligible Items:>

General items

Examples:

*1. The tax-free purchased items must be taken out of the country.

*2. Purchases at the same store on the same day must total at least 5,000 yen (excluding tax).

Consumable items

Examples:

*1. The tax-free purchased items must be taken out of the country.

*2. Purchases at the same store on the same day must total at least 5,000 yen and no more than 500,000 yen (excluding tax).

*3. Consumable items will be provided to you packaged (in bags or cardboard boxes) according to certain methods.

*4.Do not open the packages within Japan.

*5. If the items are consumed or the packages are opened in Japan, you may be required to pay the consumption tax at the time of departure.

Delivery slips can no longer be used to show your eligibility for tax-free(2025/4/1~)

From April 1st, 2025, you will not be eligible for tax-free shopping if you send your tax-free items back home on your own via international parcels. You will have to present the tax-free items at customs during customs examination if requested.

Delivery slips can no longer be used to show your eligibility for tax-free

For easier purchasing: Utilize VJW

Individuals with "Short-Term Stay" or "Diplomatic/Official" residence status can make tax-free purchases quickly by registering with VJW. The procedure can be completed by simply presenting a QR code, so please take advantage of this service.

1.Generate a Tax-Free Shopping QR Code on VJW

Log in to VJW and create a "Tax-Free Shopping QR Code."

For more details, please visit the Digital Agency's website (Visit Japan Web | Digital Agency).

2.Present the Tax-Free Shopping QR Code at Stores

Tax-free shops that accept VJW display the following mark.

*Not all tax-free shops accept VJW, so please confirm with the store before use it.

3.Receive Confirmation at Customs

Present your passport and or other documentation at the customs office of the departure location.

*Customs officers may ask you to show the tax-free items. Therefore, it is recommended to obtain customs approval before checking in your luggage.

1.Generate a Tax-Free Shopping QR Code on VJW

Log in to VJW and create a "Tax-Free Shopping QR Code."

For more details, please visit the Digital Agency's website (Visit Japan Web | Digital Agency).

2.Present the Tax-Free Shopping QR Code at Stores

Tax-free shops that accept VJW display the following mark.

*Not all tax-free shops accept VJW, so please confirm with the store before use it.

3.Receive Confirmation at Customs

Present your passport and or other documentation at the customs office of the departure location.

*Customs officers may ask you to show the tax-free items. Therefore, it is recommended to obtain customs approval before checking in your luggage.